What to Expect When Asking Your Lender for Temporary Relief

Homeowners often understand what mortgage forbearance is, but the more pressing question tends to be:

Can I receive mortgage forbearance based on my specific situation…and should I?

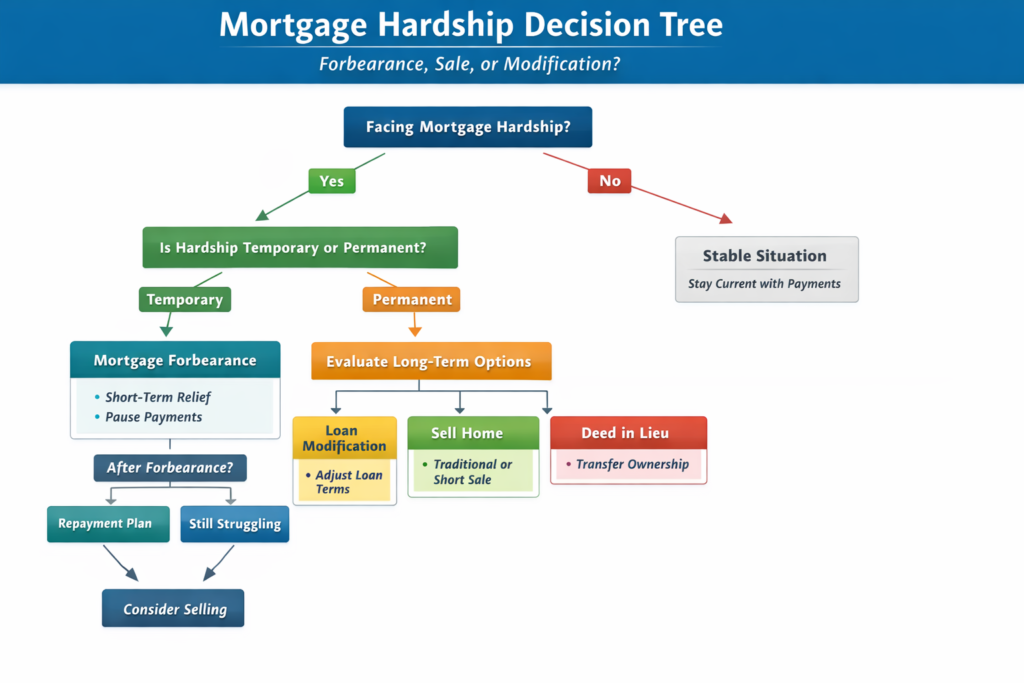

This guide focuses less on definitions and more on eligibility, lender decision-making, and strategic next steps. In other words, it’s about whether forbearance truly helps you, and how it fits into a broader financial plan that may also include selling your home or exploring a short sale.

How Lenders Decide If Mortgage Forbearance Is an Option

Mortgage forbearance is not automatic. Loan servicers evaluate requests based on a combination of factors, including:

- The type of hardship (temporary vs. ongoing)

- The expected duration of income disruption

- Your payment history prior to hardship

- The investor guidelines tied to your loan

- Whether alternative solutions may be more appropriate

The key question lenders are trying to answer is simple:

Is this a temporary setback, or a longer-term affordability issue?

Common Situations Where Forbearance Is Considered

You may be a candidate for mortgage forbearance if you are experiencing:

- A temporary job loss or reduction in income

- Medical or caregiving-related expenses

- Business disruption or self-employment income volatility

- A short-term financial shock that is expected to improve

In these cases, forbearance can serve as a pause button, giving you time to stabilize without immediately defaulting on your loan.

When Forbearance May Not Be the Best Solution

Forbearance works best when income recovery is realistic. It may be less effective if:

- Income has permanently declined

- The mortgage payment was already difficult before hardship

- Large arrears would be impossible to resolve later

- Equity is limited and refinancing is unlikely

In these situations, delaying the issue can actually reduce future options.

This is where proactive planning matters most.

What to Ask Before Accepting Mortgage Forbearance

Before agreeing to any forbearance terms, homeowners should clearly understand:

- How deferred payments will be resolved

- Whether repayment options are flexible

- How long relief lasts versus how long recovery may take

- What alternatives are available if recovery does not occur

Servicers may outline several exit paths, and the details matter.

The Consumer Financial Protection Bureau recommends that borrowers fully understand post-forbearance obligations before agreeing to any terms.

The Strategic Link Between Forbearance and Short Sales

Forbearance is designed to buy time, not eliminate debt. If circumstances do not improve, homeowners often find themselves facing a second decision point.

At that stage, options may include:

- Loan modification

- Refinancing (if equity and credit allow)

- Selling the home

- Pursuing a short sale with lender approval

A short sale, when evaluated early, can sometimes be a more controlled outcome than allowing missed payments to accumulate or facing foreclosure pressure later. This is why forbearance and short sales are often discussed together—not because one leads to the other, but because both are tools within a larger decision framework.

Comparing Forbearance to Other Exit Strategies

| Option | Best Used When |

|---|---|

| Mortgage Forbearance | Hardship is temporary |

| Loan Modification | Payment needs long-term adjustment |

| Refinancing | Equity and credit remain strong |

| Traditional Sale | Equity is sufficient |

| Short Sale | Home value is less than loan balance |

| Deed in Lieu | Sale is not feasible |

Choosing the right path depends on timing, equity, and future income expectations.

Frequently Asked Questions About Recieving Mortgage Forbearance

No. Approval depends on loan type, investor rules, and documented hardship.

Often yes, but options may narrow over time. Early planning helps preserve flexibility.

Many homeowners do. A sale—traditional or short—can be part of a forbearance exit strategy.

No. It temporarily pauses enforcement while other solutions are evaluated.

Questions You May Be Asking

- Are you unsure whether forbearance truly fits your situation? Schedule a confidential homeowner strategy review

- If long-term affordability is uncertain, explore selling or short sale options before choices narrow.

Authors

Bill Byrd and Waverly Byrd bring deep real estate expertise to clients throughout the Charleston area, drawing on years of hands-on experience with residential sales, investment property, relocation, and local market strategy. Their guidance is grounded in market knowledge, careful analysis, and a commitment to helping clients make well-informed real estate decisions.

As a father-and-daughter team, they work collaboratively on every transaction, combining experience, perspective, and consistent communication. Clients benefit from a coordinated approach that emphasizes preparation, clarity, and thoughtful execution at each stage of the buying or selling process across the Lowcountry.