Common Red Flags, Prevention Steps, and Best Practices

Wire fraud in South Carolina real estate is real…and it remains one of the most devastating financial crimes affecting home buyers, sellers, and investors. While the technology behind these scams evolves, the core strategy used by cybercriminals has not changed: create urgency, impersonate trusted professionals, and trick someone into wiring money to the wrong account.

Because real estate transactions often involve large wire transfers and tight deadlines, they remain a prime target. Therefore, understanding how wire fraud works—and how to prevent it—should be part of every buyer’s and seller’s strategy, regardless of market conditions.

How Real Estate Wire Fraud Happens

The goal of a cybercriminal is simple: redirect legitimate funds to a fraudulent bank account. This is usually accomplished through email compromise or phishing tactics.

In many cases, criminals:

- Gain access to an email account involved in the transaction, or

- Create a nearly identical email address that appears legitimate

They then monitor correspondence to identify:

- The buyer, seller, agent, lender, and closing attorney

- The timing of earnest money, down payments, or closing proceeds

At the most critical moment, a message is sent requesting that funds be wired—often with new or “updated” wiring instructions.

What makes these scams effective is that they often look routine, timely, and familiar.

Who Is Most at Risk?

Anyone involved in a South Carolina real estate transaction can be targeted, including:

Buyers

Buyers frequently wire earnest money, down payments, and closing costs. These wires are often large and time-sensitive, making them a primary target.

Sellers

Sellers may wire proceeds to another bank, an investment account, or a 1031 intermediary. Fraudsters know these transfers are expected and less likely to raise suspicion.

Closing Attorneys

Attorneys routinely wire payoff funds, seller proceeds, and commission checks—creating multiple opportunities for fraud attempts.

Lenders & Service Providers

Mortgage lenders, title companies, and vendors may also be impersonated during the transaction.

Because multiple wire transfers occur in a single closing, criminals only need one moment of inattention to succeed.

What Wire Fraud Often Looks Like

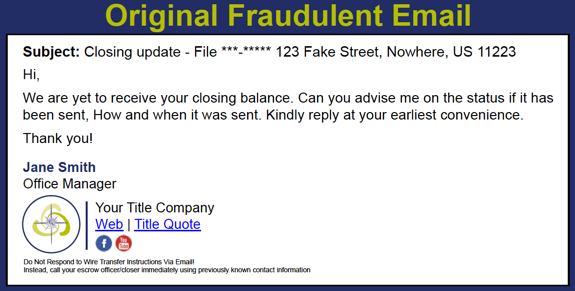

Fraudulent messages frequently share common warning signs:

- A strong sense of urgency (“must be completed today”)

- Slightly unusual wording or grammar

- Requests to “kindly” confirm or act immediately

- Email signatures that appear correct but are subtly altered

- Instructions that differ from prior conversations

The most dangerous aspect is that the request itself often seems reasonable, especially when buyers or sellers are already expecting to wire funds.

How to Protect Yourself From Wire Fraud in South Carolina

While no system is perfect, these steps dramatically reduce your risk:

- Never rely on emailed or texted wiring instructions

- Always verify wiring details by phone or in person using a known, trusted number

- Confirm routing and account numbers verbally

- Be suspicious of last-minute changes, even if they appear to come from a trusted professional

- Slow down—urgency is a red flag

Many real estate professionals also provide wire fraud disclosures, including forms promoted by the South Carolina Real Estate Commission, to help educate clients before funds are transferred.

Why This Matters in Short Sales & Distressed Transactions

Wire fraud risk can be even higher in short sales and complex transactions, where:

- Multiple lenders are involved

- Payoff figures change

- Timelines are extended

- Buyers and sellers are under emotional or financial stress

These situations create more communication, more documents, and more opportunities for impersonation. This is why buyers and sellers navigating short sales should work with experienced professionals who understand both the financial complexity and the fraud risks involved.

Our Role as Your Real Estate Advisors

Protecting your interests means more than negotiating price and terms. It also means educating you about risks that could derail your financial future.

After decades in South Carolina real estate, we have seen many market cycles and scams—but few have been as financially devastating as wire fraud. Awareness, verification, and professional guidance remain your strongest defenses.

Frequently Asked Questions About Real Estate Wire Fraud in South Carolina

Yes. Wire fraud continues to impact transactions statewide and nationally, regardless of market conditions.

In most cases, no. Once funds are wired and withdrawn, recovery is extremely difficult.

Many professionals will send instructions, but they should always be verified verbally before any money is sent.

Both are targeted, but buyers wiring large sums near closing are particularly vulnerable.

Yes. Clear communication protocols and proactive education significantly lower exposure to fraud.

Questions You Maybe Asking

- Are you concerned about protecting your funds?

- Would you like to know how we safeguard our clients from wire fraud at every step.

Let’s walk through your transaction safely. Work with professionals who understand both the risks and the solutions.

Authors

Bill Byrd and Waverly Byrd bring deep real estate expertise to clients throughout the Charleston area, drawing on years of hands-on experience with residential sales, investment property, relocation, and local market strategy. Their guidance is grounded in market knowledge, careful analysis, and a commitment to helping clients make well-informed real estate decisions.

As a father-and-daughter team, they work collaboratively on every transaction, combining experience, perspective, and consistent communication. Clients benefit from a coordinated approach that emphasizes preparation, clarity, and thoughtful execution at each stage of the buying or selling process across the Lowcountry.