A Simple Explanation of How 1031 Exchanges Work and When They Apply

Let’s explore 1031 Tax Deferred Exchange Basics and how you can defer your capital gains when exchanging “like kind” investments. To begin I’d like to share that during my career I’ve worked with numerous investors, invested in many properties myself. I have built custom homes, developed land, taught real estate law and pre-licensing at the College of Charleston and more. I participated in my first 1031 Tax Deferred Exchange in 1992 and have been involved in many others since then. More about Bill

Covering The Basics of a 1031 Tax Deferred Exchange

What we will cover!

- What a 1031 Tax Deferred Exchange is?

- Why now is a great time to take advantage of a 1031 Tax Deferred Exchange?

- Why do a 1031?

- What are the 4 levels of Capital Gains Tax?

- What is a “like kind” property?

- The Exchange Equation, how capital gains are deferred.

- The Delayed Exchange and Time Requirements.

- Property Identification Rules and Parking Arrangements.

- Section 1031 & 121 of the IRS Code.

- Third Party Intermediaries.

To start, it’s important for each investor, to review your specific situation with your tax and legal advisors. And…ideally…have these conversations well before you list and negotiate the sale of the property you’ll be using in the exchange.

In this overview of 1031 Tax Deferred Exchange Basics, I’m going to pack in a lot of information. Also, I’m not going to go into great detail on any one particular topic. But, for those of you that are new to 1031 exchanges, you’ll get a good introduction. We will look at the time deadlines and the process involved. And, you’ll discover how you can use section 1031 to defer the capital gains on your investment properties!

Potentially 4 Different Levels of Tax

1031 exchanges are a vital part of the tax code. IRC section 1031 is the section of the code that provides the guidance for this capital gains tax deferral strategy. The IRC Section 1031 gives investors the ability to defer capital gains taxes on the sale of any real property. But it has to be property that is held for productive use in business or for investment. The code allows taxpayers and business owners to potentially defer up to four levels of taxation on a sale of investment property. That is, if the investor did not sell and exchange a property under the guidelines of a 1031 exchange.

Since 1921

Section 1031 has been part of the tax code since 1921. With a 1031, the rationale behind the capital gains tax deferral is that there is a continuity of investment liquidity when a taxpayer sells a piece of real property, that they’ve been holding for investment or using it for a business, and then reinvests into…another, “like kind” property. So, in a 1031 the investor is not actually receiving the cash proceeds, the cash or equity is just going from one investment property to another investment property. The deferral of these capital gains taxes makes the 1031 a very powerful strategy for business owners and real estate investors looking to improve their investment returns.

The Perfect Storm For 1031 Tax Deferred Exchanges

We have what we call right now the perfect storm for 1031 Tax Deferred Exchanges. This perfect storm is being driven by a couple of factors. One is that the current administration is looking to increase capital gains taxes significantly. And over the years certain groups have tried to remove section 1031 from the code! So maybe, it might be a good idea to take advantage of a section of the code!

Additionally, a new tax was recently added in the mix, the “net investment income tax”. This tax is added on to the capital gains taxes of certain higher earners. So, with the possibility of higher capital gains tax rates on the way for real estate investors, the 1031 exchange may become more popular and useful in the next few years.

Strong Markets

Now, coupled with that, we’ve got very strong financial and real estate markets. From the stock market to real estate, we’ve seen several good years. In fact, right now even in the wake of the Covid-19 Pandemic, the markets have been doing incredibly well. Residentially, commercially, nationally, we’ve seen very strong markets in just about every area of the country. So, what that means is that investors have seen significant appreciation in the values of their real estate assets. And when they go to sell these assets the capital gains tax could be significant.

So, the bottom line is we have taxpayers that own investment properties that have increased dramatically in value. These investors can now use the 1031 as a way to potentially defer paying taxes on their gains. Effectively pushing that tax liability into the future.

Why a 1031 Tax Deferred Exchange?

There are a lot of reasons why people consider an exchange and I’m going to go through a few of the motives.

Creating Leverage with the 1031 Tax Deferred Exchange

One is obtaining more leverage. If a taxpayer has significant equity in a property, they may not be getting the best return on investment. Taxpayer’s that have a lot of equity in a property, may want to exchange out of it and acquire other property with a better rate of return.

Diversification

Some taxpayers use a 1031 exchange for diversification purposes, and there are really two ways to do that

One, a taxpayer can diversify geographically. If a taxpayer has a lot of properties in one marketplace, they may want to exchange out to another marketplace. They might do this to take advantage of different economic conditions in a different area and create more diversification.

Sometimes investors look to diversify by asset class. A single-family home investor may want to exchange into a multifamily property or maybe an industrial or commercial property. So, you can diversify both geographically and by asset class.

Consolidation

Consolidation is a very popular strategy. There are many real estate investors nationwide that started investing in single family homes. After aquiring a large portfolio of several single-family homes, they may consider consolidating that equity that into one larger investment. Investments like an apartment, a multifamily building or an office building may simplify management responsibilities.

Cash Flow

Cash Flow is another powerful motivator. Plenty of people here in our area own land with a lot of equity, but it’s not producing cashflow. A land owner/investor may exchange out of raw land, into income producing property and pay no capital gains. Now can create an income stream where there was once no cash flow! And, if done right can create a legacy for their heirs for generations!

Management Relief

Management relief is another motivating factor. A investor might decide to exchange out of several properties, and exchange them into a larger multi-family or office building. Some investors want to increase their upside appreciation and depreciation opportunities. A taxpayer can go up in value, acquire a larger building, and then get some additional depreciation as well as appreciation. Remember a percentage of a bigger number is always a much bigger number!

Estate Planning Using the 1031 Tax Deferred Exchange

And then finally, estate planning. Many older taxpayers may have a lot of their equity in one large property. Proper estate planning can help them take advantage of 1031 exchange. Some taxpayers will sell a property and acquire several smaller properties selected by their heirs. They do this as a way to allow family members to basically pre-select their inheritance while the taxpayer is still alive. This is a way of deferring tax gains and reducing inheritance taxes at the same time.

4 Levels of Taxation

Let’s take a look at capital gain taxation. This is critically important to understand. Taxpayers face potentially four different levels of taxes.

Depreciation Recapture

Taxes are first assessed on any depreciation recapture and depreciation recapture is taxed at a higher rate of 25%. If a taxpayer owned a property for several years, they’ve probably taken some depreciation. So when they sell, they’re going to have to pay taxes on that recapture that depreciation.

Federal Taxes

Then on the remaining economic gain, the investor will be taxed at the federal level. Which could be either 15% or 20%, depending on what the tax rate the individual investor’s tax rate is.

Net Investment Income Tax

Net investment income tax is a tax that affects many higher income earners. This is a 3.8% tax that is assessed on investors that meet the following criteria.

Single filers with over $200,000 of net investment income. Married taxpayers filing jointly with over 250,000 of net investment income.

State Caital Gains Tax

And then finally, is the applicable state capial gains tax rate.

It’s important to keep in mind, you could potentially face all four levels of taxes.

And when you do the math, you may be paying significantly higher capital gains taxes than you expected! Meaning, the taxes are going to eat into the projected profit that you thought you’d have. And that’s why investors use the 1031 exchange. It’s a tool to improve the rate of return and to really push that tax liability into the future.

Real Estate Investment Stratigies

Buy and Hold

Now, as a real estate investor, you really just have three strategies with your real estate. One is to buy and hold. Many taxpayers will do that. Buy a property, hold it for the long-term and pay down the mortgage, while slowly bumping up rents.

Buy and Sell

The second strategy is to buy and sell a property. So, you sell the property and pay all of the taxes owed. In this scenerio you could potentially you pay all four levels of taxation. Now you’ll have the after-tax equity that you can invest into things outside of real estate. Stocks, bonds, mutual funds, energy, commodities, and any other type of investments. There are many investors that do this as part of a long-term strategy to diversify out of real estate.

ROI

One aspect that I’d like to point out is that it’s very difficult to obtain the same rate of return, the same ROI with after tax dollars that are invested outside of an investment real estate. The real benifit of the 1031 Tax Deferred Exchange is the aspect of leveraging all of you equity into another property or properties. Basically keeping all of the gross equity and redeploying that into another investment property. It simply makes more sense that it you have more dollars to spend you can buy more! So purely from a return-on-investment standpoint, there might be a little bit of an economic hit when you don’t use the 1031 exchange and buy other investments with after tax dollars.

Again, many investors may want to diversify out of real estate in the future, and by using a 1031 they’ll be postponing that tax liability and pushing that into the future. However, there will be a point in time when they want to go ahead and liquidate some real estate pay the taxes owed, if that’s part of their long-term strategy.

Using The 1031 Tax Deferred Exchange

And then finally, with 1031 Tax Deferred Exchange real estate investors can do a fully deferred exchange. That’s where they pay no capital gains taxes and defer all of the capital gains tax.

However, some investors may opt for what we call partial tax deferral. They may sell property and buy one or two replacement properties but receive some cash out of the transaction. That’s cash is called cash boot. Any cash pulled out of a transaction is taxable. If that taxpayer also has a reduction in their mortgage owed, that is called mortgage boot, and mortgage boot is also taxable. With that said, many investors will still proceed with a partially deferred exchange and take advantage of what a section 1031 exchange offers and be happy paying some taxes on that boot. That’s just another strategy that’s available.

IRC Section 1031: The Code

Let’s just take a quick look at the actual tax code itself. The tax code says this:

No gain or loss shall be recognized on the exchange of real property held for productive use in the trade or business or for investment. If such real property is exchanged solely for real property of “like kind”, which has to be held either for productive use and a trade or business or for investment.

Some key takeaways looking at the code; number one, looking at the first line, this is what we call “non-recognition treatment”. Meaning, the cash, or tax liability, follows the taxpayer from the relinquish property, and that basis gets rolled over into the replacement property. Keep in mind, the taxes don’t go away. Sometimes you’ll hear people incorrectly call a 1031, a tax-free exchange. When in fact it’s not, it’s tax deferred. We’re just pushing the tax liability into the future. It’s called non-recognition treatment.

A 1031 Tax Deferred Exchange is More Flexible Than Most Expect

Now the types of property that qualify are very broad. It could be an investment property for an investment property. You could exchange a business property for another business property. Or exchange an investment property for a business property or a business property for an investment property. As you can see, there are a lot of options.

And when we look at the whole concept of “like kind” property, which we’ll look at shortly, “like kind” property is very, very broad. So, it’s only real property. Real property is real estate. Personal property does not qualify for a 1031 Tax Deferred Exchange.

Exclusions from the 1031 Tax Deferred Exchange

Now there are some investment properties that are excluded from the code. The first is, Stock in Trade or other property held primarily for sale. Stock and trade is typically going to be inventory held in the ordinary course of business for sale to customers. An example would be a home builder or home flipper. Someone that’s holding inventory to sell it. In other words, if the intent of the taxpayer is to hold a property for sale, and not a long-term investment it will not qualify for a 1031 Tax Deferred Exchange. Typically when we are talking about a long-term investment, we are generally referring to income producing properties, unless it’s bare land.

“Like Kind” Property and the 1031 Tax Deferred Exchange

The image below shows all the different types of “like kind” real property. You see on the upper row, a farm, a single-family home, an office building. And then as you go down, you’ll see all sorts of other types of properties, a rental vacation home, bare land, an office building retail, industrial, multifamily, and the list goes on and on. Any real property held for investment, can be exchanged for any other real property held for investment.

So the key thing to remember here is that the term “like kind” property as defined by the code can be fairly expansive and broad!

Some people have misconceptions about what “like kind” truely means. Some folks think that if it’s bare land, you have to acquire bare land and that’s not true. You can actually sell out of bare land and buy into an income property. You can go from a single-family rental into an office, industrial or retail property. They’re all considered “like kind” properties.

Other “Like Kind” Considerations

Now let’s take another look at some “like kind” property issues. First off, the house that a taxpayer lives in, their principal residence, generally does not qualify as “like kind” property because the taxpayer lives in it. Number two, as we mentioned before, any property held for sale would not qualify.

So, what’s important is if the intent of the property is to be held for sale, not long-term investment, that property is also excluded. Sometimes you hear that referred to as dealer property. Any other real property that is held for productive use in a trade or business, or for investment can be exchanged for any other real property held for productive use in a trade or business or for investment. So there really are a lot of “like kind” alternatives available to investors.

Intent

Alot of people will ask, how long do I need to hold a property before it’s considered held for investment? And the answer is that it’s more than just the time period. It really comes down to what is the intent of the taxpayer and is their intent to hold for investment or not. So the intent is very internal, right? It’s subjective. So we find that the IRS and the tax authorities, they’re going to look at objective and provable facts. Facts that either support the intent to hold for investment or contradict yet. So either way, they’re going to look at each taxpayer’s unique situation and their unique facts and circumstances regarding their property.

So is the time period important? Of course it is, but there is no set time period that you have to hold a property. It’s really just one of many factors. So in a perfect world, it would be ideal to have many factors and attributes showing that the intent is to hold the property for investment versus another intent. And, to the extent that you have a lot of contradictory factors, the IRS might conclude the property was really not held for investment.

The 1031 Tax Deferral Exchange Equation

In order to realize a full tax deferral on the sale of a property, a taxpayer just needs to meet two requirements. One, they need to re-invest all of the net exchange proceeds of the relinquished property. And two, acquire a “like kind” property with the same or greater amount of debt. Those are the two basic rules.

What is “Boot” in a 1031 Tax Deferred Exchange

Another way of saying this is to spend all of the cash equity and buy at the same net sales price or greater. So, again if the taxpayer receives any cash out, that is called cash boot, and if they have a reduction in the mortgage liabilities, that’s called mortgage boot.

Full Tax Deferral

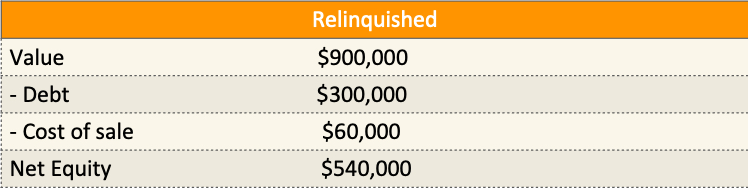

In the diagram below the taxpayer sells a relinquished property for $900,000., the debt or the loan payoff is $300,000., the cost of sale is approximately $60,000. Cost of sale would include things like real estate commissions, recording fees, fees to prepare the settlement statements, preparing the deeds etc. So when we subtract the debt and cost of sale from the value we are left with net proceeds of $540,000

In the next example, the buyer is buying a more expensive property. They buy a replacement property for $1.2 million. Their debt goes from $300,000 to $660,000. and there’s no mortgage boot because they went up in debt. They also reinvested all of their net equity/proceeds of $540,000 that was held in escrow by the qualified intermediary. Since all of the equity is reinvested in the replacement property and the investor never touches the cash the exchange qualifies for a full tax deferral.

So, there is no mortgage boot and no cash boot. And there is a full tax deferral. Keep in mind the investor could have exchanged into multiple replacement properties rather than if they had chosen to do so!

Cash Boot and Mortgage Boot

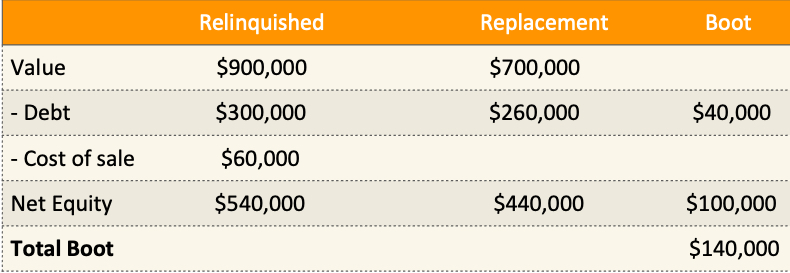

In the next example, the taxpayer sells a property for the same amount, but they buy a replacement property for only $700,000. So they’ve lowered the value of their investment.

The debt goes from $300,000 to $260,000. which creates $40,000 of mortgage boot. Additionally, they only reinvest $440k of their net proceeds. And this creates an additional $100k of cash boot.

Now you add those two together and this exchange will result in a total boot of $140,000. Creating a $140k tax liability.

Mortgage Boot

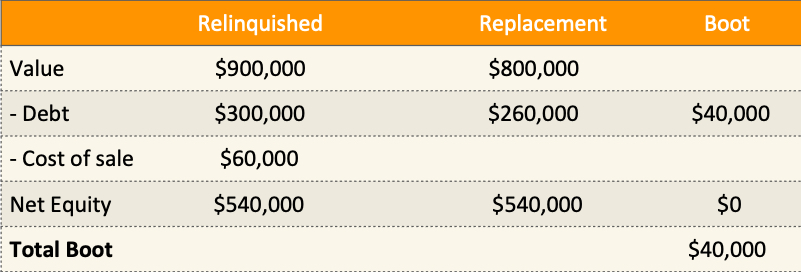

And then finally, one last example. In this example the taxpayer buys a property for 800,000 and they reduce their debt by $40,000. But they reinvest all their cash in the new property.

This creates $40,000 of mortgage boot. Most investors know intuitively if you receive cash, it’s going to be taxable, but it’s important that you look at both the cash and the debt. If you have less mortgage on the replacement property than the relinquished property, you’ll also pay taxes on the mortgage boot as well.

So again, to summarize for full tax deferral, you want to reinvest all of the net exchange proceeds. Number two, you want to acquire property with the same or a greater amount of debt.

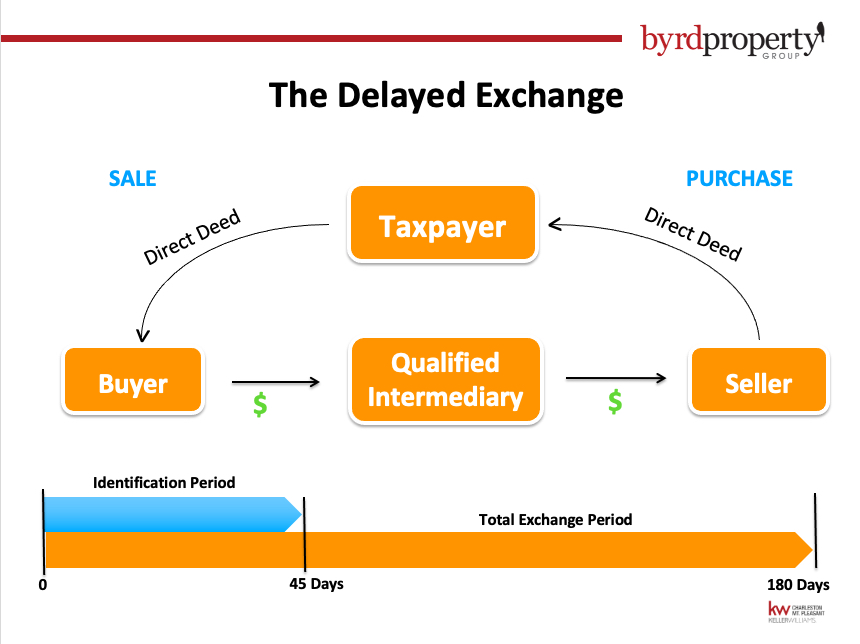

The 1031 Tax Deferral Delayed Exchange

Now, let’s take a look at the delayed exchange process and the time deadline requirements. The delayed exchange is the most common exchange formats. What’s critically important is that you set up a 1031 exchange prior to closing on the sale of the relinquished property, the one you’re exchanging. If you’ve already closed, it’s too late to set up a 1031 Tax Deferred Exchange.

So, in a proper sequence you and your agent connect with a closing attorney and a qualified intermediary in advance of the sale. Your agent will make sure the right language is in the listing and the sales contract. While the closing attorney and the qualified intermediary will prepare the necessary paperwork and documents to process the exchange.

Once the property is sold, through an assignment of the contract the Qualified Intermediary becomes the seller in the first part of the exchange. At closing the buyer pays for the property and the money is held in escrow by the qualified intermediary. The qualified intermediary then instructs the closing attorney to directly deed the property from the taxpayer to the buyer. The qualified intermediary will then hold the proceeds of the sale in escrow until the replacement property is purchased.

Timing of The Delayed Exchange

The date the closing of the relinquished property becomes day zero of the identification period in the delayed exchange. The taxpayer then has up to 45 calendar days to identify a replacement property or properties. Additionally, they will have another 135 days, for a maximum of 180 days to acquire the replacement property.

Once the taxpayer selects or identifies the replacement property or properties, they then assignment of the contract to the qualified intermediary. At that time the qualified intermediary will then act as the buyer of the replacement property. When closing occurs, the proceeds from the sale of the relinquished property will then be used to purchase the replacement property. At which time the qualified intermediary will instruct the closing attorney to directly deed the replacement property to the taxpayer

So you see the taxpayer does not actually sell the relinquished property, the qualified intermediary sells it to the buyer, and the qualified intermediary purchases the replacement property from the seller. The taxpayer is merely giving up a relinquish property and receiving back a replacement property. And that’s how they’re able to have a 1031 Tax Deferred Exchange. They’re just giving up a property, held for investment and then receiving another property, a like kind property also to be held for investment

Delayed Exchange Timing Deadlines

To reiterate, during the Identification Period the taxpayer has until midnight of the 45th day after closing on the relinquished property to identify a replacement property or properties. Then the exchange period is 135 days from the end of the identification period for a maximum of 180 calendar days. And when I say calendar days, remember these are going to go through weekends and holidays.

Another wrinkle in the dealines revolves around when the taxpayer file their tax return for the year that the relinquished property was sold in. What this means is that you have to close on the replacement property within 180 days or before you file your taxes. This is another reason why you’ll want to plan this out and counsel with your tax and legal advisors well before putting a property on the market.

Rules For Identifying Property For Your 1031 Tax Deferred Exchange

Now there’s a few rules for identifying a replacement property or properties in a 1031 Tax Deferred Exchange.

The 3 Property Rule

The first is called the three-property rule. Here a taxpayer can identify three “like kind” replacement properties of any fair market value. As an example, they sell a property for a million dollars, then they identify one at a 1 million, one at 1.8 million and one at 2.4 million. The value doesn’t matter, but you’re limited to three properties under the three property rule.

The 200% Rule

Second, there’s the 200% rule under this rule. With this rule the taxpayer can identify an unlimited number of “like kind” properties, however the total fair market value or aggregate value of all the replacement properties identified cannot exceed 200% of the fair market value of the relinquished property. So in this example, if I sell a property for $1 million dollars, the taxpayer can identify as many replacement properties as they want, but they can’t go over $2 million in value, which is 200%. So with the three property rule, you’re limited on the number of properties, but unlimited value. With the 200% rule it’s really the opposite of that. It’s an unlimited number of properties, but now you’re limited on the value to no more than 200% of what you sold.

The 95% Rule

And finally, the third rule is called the 95% rule. This is used by a taxpayer that wants to identify more than three “like kind” properties and more than 200% of the value of the relinquished property. With the 95% rule they can do that. However, they must then actually close on or acquire 95% of the value of all properties identified. So as an example, if I identify 10 properties, I would need to buy all 10 of them presuming they were all the same value. If I only bought nine, that would be 90% not qualifying under the 95% rule. So most taxpayers will typically use the three property rule or 200% rule, but there’s the 95% rule to offer a little extra flexibility.

Find Your Replacement Property Below

Parking Arrangements in a 1031 Tax Deferred Exchange

Now we are going to look at some other more complex variations of the 1031. These are what are called parking arrangement transactions.

The Reverse Exchange

This is where the taxpayer is going to close on the purchase of the replacement property before closing on the sale of their relinquished property. So, they buy a new property and close on it, and then have up to 180 calendar days to sell the relinquished property

The Improvement Exchange

The improvement exchange is where a taxpayer buys a new property to be built. Or it could be one that needs improvements and refurbishments. Again, just like the Revese Exchange there’s only 180 days to build or make the property improvements. So you are working with a very limited timeframe.

The Reverse Improvement Exchange

And then finally, there’s a parking arrangement known as a reverse improvement exchange. This is where the taxpayer is going to acquire the replacement property and then begin construction on that property and then have up to 180 days to close on the sale of the relinquished property.

Even though we are not going into a lot of detail here, this is to show you that the 1031 Tax Deferred Exchange has more flexibility than most people realize.

IRC Section 121 and Section 1031

Many people are already familiar with Section 121 of the tax code. These are the rules for tax exclusion on the sale of a principal residence. And I wanted to review them here now and show you how it can apply in an investment scenario. Section 1031 provides the rules used for tax deferral on any property held for investment or used in trade or business.

Section 121 provides tax exclusion up to certain threshold amounts. To qualify, the home has to have been your personal residence for 2 out of the last 5 years. And, if you’re a single filer you can exclude $250,000 of gain. If you’re a married couple filing jointly, you can exclude up to $500,000. of capital gain.

How Section 121 and Section 1031 Can Work Together

Now when it comes to IRC Section 1031, there are a few ways it can work together with section 121. Here are a few more ideas to consider.

Split Treatment

There’s what we know as split treatment. This is where somebody can sell a property that is a partial rental property and partially a residence. An example would be a duplex or fourplex where somebody that lives in one unit and rents out the others.

Convert A Rental Into A Residence

Additionally, a taxpayer can convert a rental property acquired in a 1031 exchange into a residence down the road. That would be converting a 1031 property into 121 property.

Convert A Residence Into A Rental

And then finally, taxpayers can convert a personal residence, a section 121 property, into a rental, section 1031 property.

What you’ve learned!

- We’ve discovered what a 1031 Tax Exchange is.

- Why now is a great time to take advantage of a 1031 exchange.

- Why would you want to do a 1031.

- What the 4 levels of Capital Gains Tax are.

- What “like kind” property means.

- We have reviewed the Exchange Equation.

- We’ve reviewed the Delayed Exchange and it’s Time Requirements.

- The importance of Identification Rules and Parking Arrangements.

- We’ve discussed Section 1031 & 121 of the IRS Code.

- Third Party Intermediaries.

Conclusion

I hope this presentation has given you a greater understanding of the 1031 Tax Deferred Exchange. As always, I encourage you to do your research and counsel with your tax, legal and financial advisors. You’ll want to determine if a 1031 exchange is right for your particular investment situation. And, if you’d like to discuss your real estate strategies with me, I’ll be happy to help. I can provide you with a free performance and market analysis of any investment property you own. My goal is to help people make wise decisions with their real estate and help them build generational wealth for their families through smart real estate investing.

Frequently Asked Questions About 1031 Tax-Deferred Exchanges

A 1031 exchange allows real estate investors to defer capital gains taxes by selling an investment or business property and reinvesting the proceeds into another qualifying “like-kind” property.

A 1031 exchange is tax-deferred, not tax-free. The capital gains taxes are postponed and carried forward into the replacement property, rather than eliminated.

Any real property held for investment or productive use in a trade or business may qualify, including rental homes, multifamily properties, commercial buildings, industrial properties, and vacant land.

“Like-kind” refers to real property exchanged for other real property held for investment or business use. The property types do not have to be the same; for example, land can be exchanged for an income-producing property.

No. A primary residence generally does not qualify for a 1031 exchange. However, certain strategies may allow partial use of Section 121 and Section 1031 under specific circumstances.

Investors may face depreciation recapture tax, federal capital gains tax, net investment income tax, and applicable state capital gains tax.

Depreciation recapture applies to depreciation claimed during ownership and is typically taxed at a rate of up to 25% when the property is sold.

Boot is any non-like-kind value received in an exchange, such as cash boot or mortgage boot. Boot is taxable and reduces the amount of tax deferral.

To fully defer taxes, you must reinvest all net proceeds and acquire replacement property with equal or greater debt than the relinquished property.

A delayed exchange is the most common type of 1031 exchange, where the replacement property is purchased after the relinquished property is sold, following strict IRS timelines.

You have 45 calendar days after closing to identify replacement properties and 180 calendar days total to complete the purchase of the replacement property.

Investors may use the three-property rule, the 200% rule, or the 95% rule to identify replacement properties, depending on their strategy.

A qualified intermediary is a neutral third party who holds the sale proceeds and facilitates the exchange. Investors cannot take possession of the funds during the process.

Yes, this is called a reverse exchange. It requires special structuring and must be completed within strict time limits.

Yes. Improvement exchanges and reverse improvement exchanges allow investors to use exchange funds for property construction or renovations within the allowed timeframe.

Yes. Many investors use 1031 exchanges to defer taxes, consolidate or diversify assets, and potentially pass properties to heirs more efficiently.

Yes. The IRS evaluates whether a property was held for investment based on intent and supporting facts, not just the length of ownership.

Yes. Investors may choose partial deferral by taking some cash or reducing debt, while still deferring a portion of the capital gains.

Strong real estate markets, significant property appreciation, and the potential for higher capital gains taxes have made 1031 exchanges increasingly attractive.

Investors should consult with tax and legal advisors and coordinate with a real estate professional and qualified intermediary before listing or selling a property.

About the Authors

Bill Byrd and Waverly Byrd serve clients throughout the Charleston area as Real Estate Wealth Advisors, helping individuals and families navigate complex property decisions connected to life transitions and long-term planning. Their work often involves, tax-advantaged 1031 exchanges, probate and estate property sales, divorce-related real estate solutions, trusts, and senior relocation, situations where informed coordination and careful timing can significantly impact outcomes.

With decades of experience, Bill and Waverly emphasize education, clarity, and collaboration. They regularly work alongside financial planners, tax professionals, and attorneys to help clients understand their options and align real estate decisions with broader financial and estate planning goals. As a father-and-daughter team, they guide clients through sensitive transactions with discretion, organization, and a steady, well-informed approach across the Lowcountry.