Why Online Home Values Are Often Inaccurate…and What Sellers Should Know Instead

If you’ve ever searched your home online, you’ve likely seen an instant home value pop up within seconds. These online estimates are convenient, widely used, and tempting to trust. However, Realtors frequently remind sellers that online home values are not always accurate—and there are good reasons for that.

Understanding why these estimates miss the mark can help homeowners make better decisions when preparing to sell, refinance, or plan for the future. More importantly, it helps sellers avoid pricing mistakes that can cost time, money, and opportunity.

This article explains how online home values are created, why they often fall short, and what sellers should rely on instead when accuracy truly matters.

What Online Home Values Really Are

Most online home values are generated using Automated Valuation Models (AVMs). These models use algorithms to estimate value based on large data sets.

Typically, they pull from:

- Public tax records

- Recent nearby sales

- Square footage and lot size

- Basic property characteristics

- Broad market trends

Because this information is processed automatically, values can be delivered instantly. While that speed is appealing, it comes with important limitations.

Online estimates are best viewed as starting points, not final answers.

Why Online Home Values Are Often Inaccurate

1. Algorithms Cannot See Your Home

Online valuation tools never step inside your property.

They cannot accurately assess:

- Renovation quality

- Workmanship and materials

- Layout flow and functionality

- Natural light and orientation

- Deferred maintenance

Two homes may appear identical on paper but feel very different in person. Buyers notice those differences immediately. Algorithms do not.

As a result, online values often assume an “average” condition that may not reflect reality.

2. Public Data Is Often Incomplete or Outdated

Online estimates rely heavily on public records. Unfortunately, public records are not always current or correct.

Common issues include:

- Renovations that were never recorded

- Permits that are missing or delayed

- Incorrect square footage

- Misclassified property features

In fast-moving markets, recent sales may not yet appear in public data. Because of that lag, online values can trail the market—sometimes by months.

3. Micro-Location Differences Are Hard to Measure

Real estate value is hyper-local. Even small differences can affect price.

Algorithms struggle to adjust for:

- Busy road versus quiet street

- Flood zone variations

- Views and privacy

- Lot shape or topography

- Proximity to nuisances

A home two doors down may sell for significantly more or less than another, despite similar data points. Automated systems rarely capture those nuances well.

4. Condition Is Largely Invisible to Algorithms

Online models typically assume:

- Functional systems

- Reasonable maintenance

- Average interior finishes

They cannot reliably evaluate:

- Roof age

- HVAC condition

- Moisture or foundation concerns

- Cosmetic versus structural issues

As a result, a well-maintained home and one that needs substantial work may receive similar online values, even though buyers would price them very differently.

5. Unique Homes Break the Model

Online home values perform best in areas with:

- High transaction volume

- Similar homes

- Repetitive layouts

They struggle with:

- Historic homes

- Custom-built properties

- Waterfront or marsh-front homes

- Rural land or acreage

- Mixed-use or income-producing properties

When true comparable sales are limited, algorithms fill the gaps with assumptions. Those assumptions often reduce accuracy.

6. Buyer Behavior Is Not a Formula

Markets are driven by people, not spreadsheets.

Online valuations cannot fully account for:

- Current buyer demand

- Emotional appeal

- Competition and multiple offers

- Seasonality

- Pricing psychology

A well-priced home may sell quickly above expectation, while a similar home may sit unsold if priced incorrectly. Algorithms do not feel urgency, hesitation, or enthusiasm.

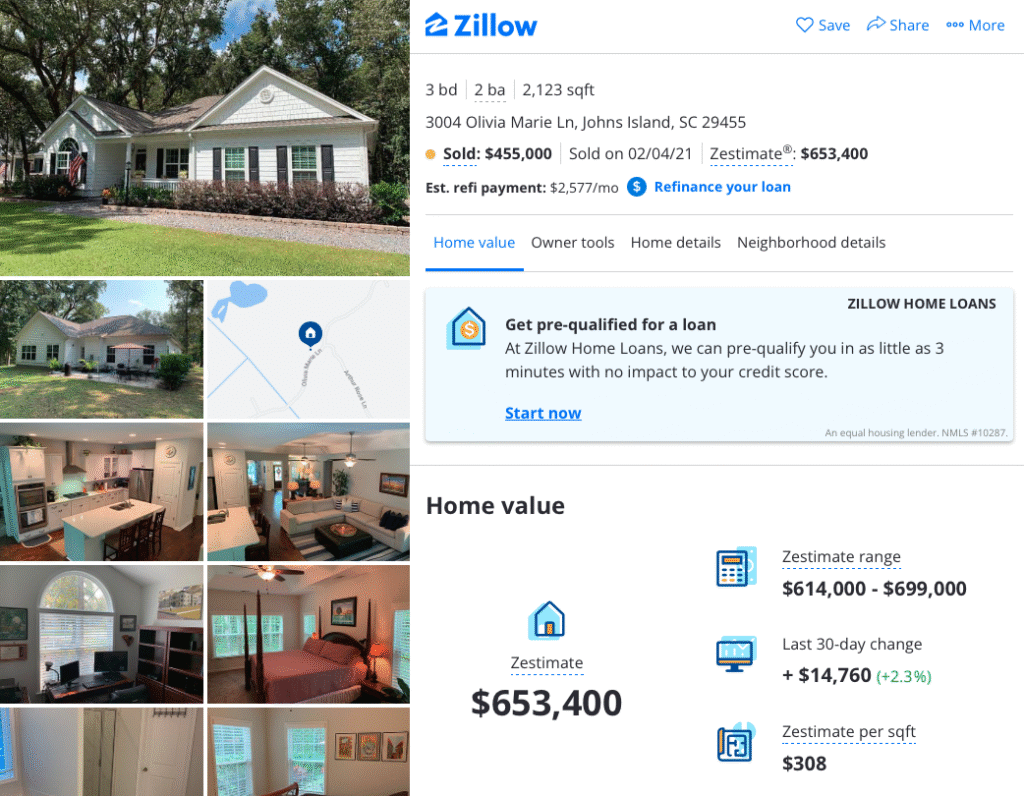

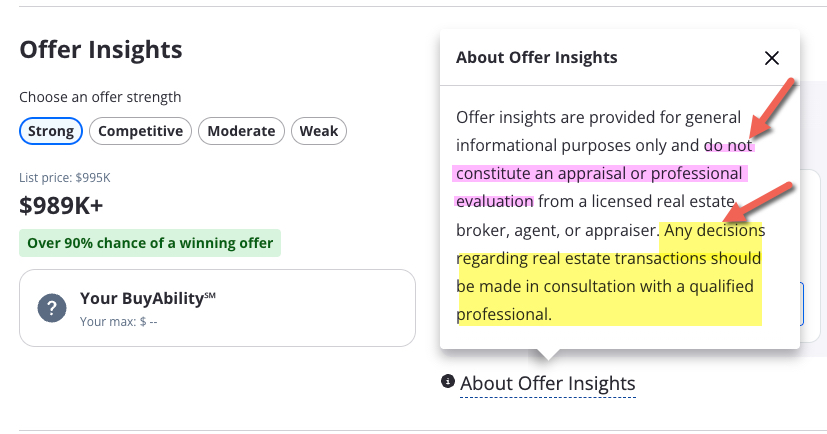

7. Even Online Valuation Companies Disclaim Accuracy

Most online valuation platforms openly state that:

- Their estimates are not appraisals

- Accuracy varies by market

- Values should not be relied upon alone

These disclaimers exist for a reason. Online values are designed for convenience, not precision.

Why Professional Pricing Is Different

A professional home evaluation blends data with human insight.

A skilled local agent:

- Verifies public records

- Adjusts for condition and upgrades

- Studies current buyer behavior

- Analyzes comparable sales in context

- Accounts for market momentum

Instead of relying on averages, professional pricing focuses on how buyers are actually responding right now.

That distinction can mean the difference between:

- Pricing too high and missing momentum

- Pricing too low and leaving money on the table

- Pricing strategically and creating strong demand

The Risk of Relying Too Heavily on Online Values

Pricing decisions based solely on online estimates can lead to:

- Extended time on market

- Repeated price reductions

- Lower final sale prices

- Reduced buyer confidence

Once a home sits too long, buyers begin to wonder what is wrong. Even a good property can lose leverage if it enters the market overpriced.

Online Values as a Starting Point…Not a Strategy

Online home values are not useless. They can provide:

- A general range

- A rough sense of market direction

- A conversation starter

However, they should not be the final word when making major financial decisions.

For sellers, pricing is a strategy—not a guess.

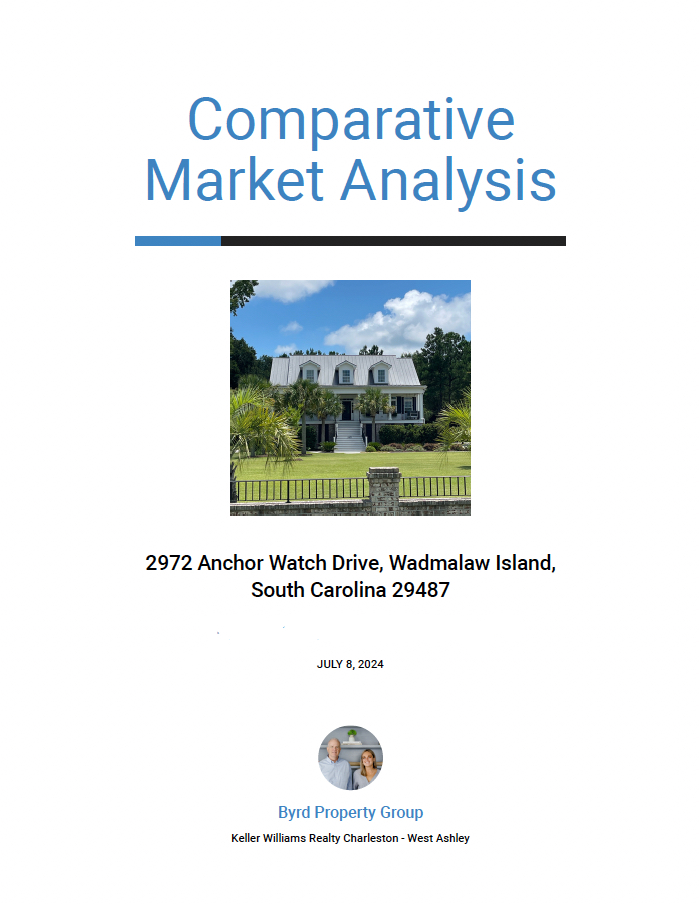

What Sellers Should Use Instead

A well-prepared pricing approach typically includes:

- A professional comparable market analysis

- An in-person property review

- Local market trend evaluation

- Buyer demand assessment

- Clear pricing objectives

This approach is especially important in markets where values have changed rapidly or where properties vary significantly.

Why Local Expertise Matters

Local experience adds context that national algorithms lack.

A local advisor understands:

- Neighborhood-specific pricing patterns

- What buyers are prioritizing right now

- How similar homes are performing

- Where the market is heading, not just where it has been

That insight allows sellers to price with confidence and clarity.

The Bottom Line on Online Home Values

Online home values are convenient, fast, and widely used—but they are not always accurate.

They often:

- Miss property-specific details

- Lag real-time market shifts

- Overlook condition and quality

- Struggle with unique homes

They are best used as a reference point, not a decision-maker.

When accuracy matters, professional evaluation remains the most reliable path forward.

Frequently Asked Questions – Why Online Home Values Are Often Inaccurate

Online values update automatically as new data enters the system. Market shifts, nearby sales, or record changes can cause frequent fluctuations.

No. Online estimates are automated and informal, while appraisals involve in-person inspections and professional judgment.

Yes. They can be reasonably close in areas with many similar homes and frequent sales. Accuracy decreases with uniqueness or rapid market change.

Realtors adjust for condition, upgrades, local trends, and buyer behavior—factors algorithms cannot fully evaluate.

Online values can provide context, but pricing should be based on a professional market analysis tailored to your specific home.

Authors

Bill Byrd and Waverly Byrd bring deep real estate expertise to clients throughout the Charleston area, drawing on years of hands-on experience with residential sales, investment property, relocation, and local market strategy. Their guidance is grounded in market knowledge, careful analysis, and a commitment to helping clients make well-informed real estate decisions.

As a father-and-daughter team, they work collaboratively on every transaction, combining experience, perspective, and consistent communication. Clients benefit from a coordinated approach that emphasizes preparation, clarity, and thoughtful execution at each stage of the buying or selling process across the Lowcountry.