Capital Gains Tax: The Wealth Destroyer

What Are Capital Gains In Real Estate?

Capital Gains In Real Estate occur when the profit you make from selling an asset, is more than your homes adjusted basis. The difference between the selling price and the basis in your home is your capital gain. These gains are classified into two types:

- Short-term capital gains: These apply if you hold the property for one year or less. They are typically taxed at your regular income tax rate. Possibly as high as 37%.

- Long-term capital gains: These apply if you hold the property for more than one year. The tax rate on long-term gains is usually lower, ranging from 0% to 20%. This or course will depend on your taxable income and filing status.

Exemptions and Exclusions

The IRS offers several exemptions and exclusions that can reduce or even eliminate the capital gains tax on real estate sales:

Primary Residence Exclusion: IRC 121

If you’re single and you sell your primary residence, you may qualify for an exclusion of up to $250,000 of capital gains. If you’re married and filling jointly, you may qualify for an exclusion of up to $500,000. To qualify, the IRS applies some strict rules. To satify the “residence test” you must have:

- Owned the home for at least two of the last five years.

- Lived in the home as your primary residence for at least two (24 months) of the last five years.

1031 Exchange: IRC 1031

For investment properties, a 1031 exchange allows you to defer paying capital gains tax into the future. However you must reinvest the proceeds from the sale into a similar or “like-kind” property. The rules for 1031 exchanges are complex, but they can be a powerful tool for investors looking to grow their portfolios.

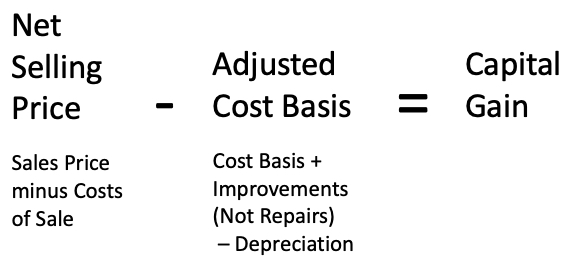

Calculating Capital Gains

To calculate it, you need to determine your property’s adjusted basis. The adjusted basis is the original purchase price, minus your costs to aquire the property, minus any accumulated depreciation claimed, plus any capital improvements made. Here’s a simplified formula:

Here is a simplified example, if you bought a property for $200,000, spent $50,000 on capital improvements, and sold it for $300,000, your adjusted basis would be $250,000. Therefore, your capital gain would be $50,000.

Maintanence is not a Capital Improvement. Examples of Capital Improvements: a room addition, adding an ADU, adding a bathroom or a kitchen upgrade.

Reducing or Avoiding Capital Gains

Several strategies can help reduce your capital gains tax liability:

Live In You House for 2 Years

If you live in your home for less than 2 years you won’t qualify for the exemption. However, in a normal real estate market it’s unlikely you’ll have a huge gain in less than 2 years.

Don’t Rent Your Home For Long Periods of Time

Remember to qualify for the exemption you will have had to of lived in the home for 2 of the last 5 years.

Timing the Sale

Selling your property in a year when your income is lower can place you in a lower tax bracket, reducing your capital gains tax rate. Or another idea would be to try to time your sale before your gains exceed your $250k or $500k exemption.

Selling Your Home Before Your Divorce

Selling your home before you get a divorce will allow you to qualify for the larger exemption ($500k) when filling a joint return.

Holding Period

By holding onto your property for more than one year, you can benefit from the lower long-term capital gains tax rate.

Offset Capital Gains with Losses

If you have other investments that have lost value, you can sell them in the same year to offset your gains with your losses, reducing your taxable income.

The IRC 1031 Exchange

If you are worried about capital gains on your investment properties you can explore deferring some of all of your capital gain by Utilizing a 1031 Exchange. If you are unfamiliar with a 1031 exchange, you should definetly do your homework, mistakes can be costly!

Reporting Capital Gains

When you sell a property, you must report the transaction to the IRS using Form 8949 and Schedule D of your tax return. Accurately reporting your adjusted basis and any applicable exclusions or deferrals is crucial to ensure you pay the correct amount of tax.

Conclusion

In conclusion, having a solid understanding of how the IRS views capital gains in real estate will allow you to keep more of your hard earned money. By making sure you qualify for the IRS Capital Gains exemptions and following the procedural rules, homeowners and investors can maximize the benefits of this tax-saving opportunity, preserving capital and expanding their real estate holdings effectively.

Please seek out professional and legal advice regarding tax and legal matters. Bill Byrd is a knowledgable real estate broker, not an accountant or lawyer.

About the Authors

Bill Byrd and Waverly Byrd serve clients throughout the Charleston area as Real Estate Wealth Advisors, helping individuals and families navigate complex property decisions connected to life transitions and long-term planning. Their work often involves, tax-advantaged 1031 exchanges, probate and estate property sales, divorce-related real estate solutions, trusts, and senior relocation, situations where informed coordination and careful timing can significantly impact outcomes.

With decades of experience, Bill and Waverly emphasize education, clarity, and collaboration. They regularly work alongside financial planners, tax professionals, and attorneys to help clients understand their options and align real estate decisions with broader financial and estate planning goals. As a father-and-daughter team, they guide clients through sensitive transactions with discretion, organization, and a steady, well-informed approach across the Lowcountry.