What does understanding cap rates mean for real estate investors?

Understanding cap rates means knowing exactly how well your property performs compared to the market. A cap rate (capitalization rate) shows the relationship between a property’s net income and its value. Use it to decide whether to keep, sell, or reinvest.

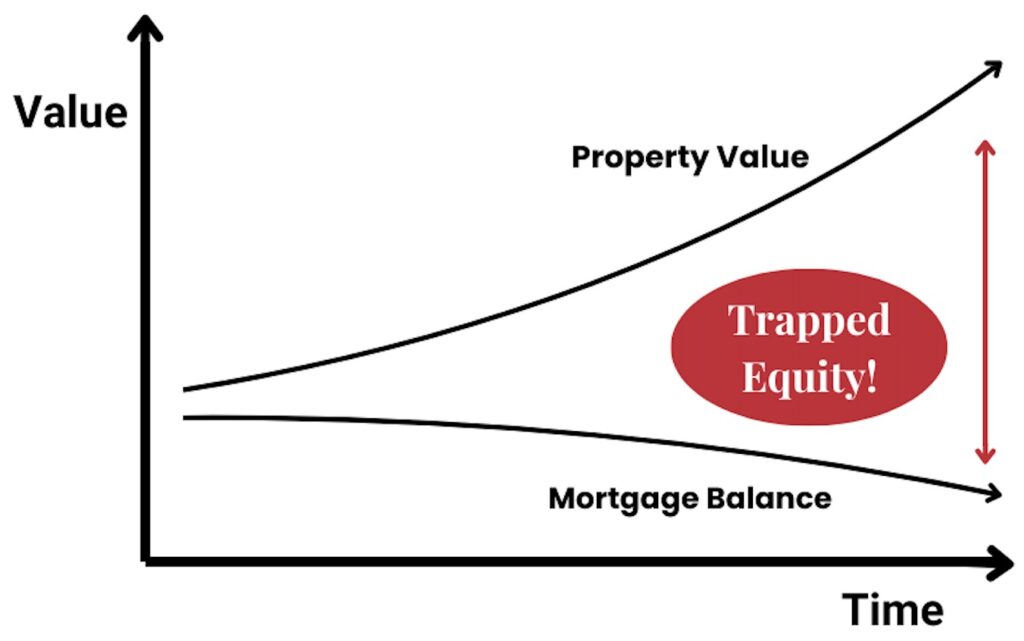

📈 Property Value vs Cap Rate

Interactive demonstration of the inverse relationship

🔑 Key Real Estate Insight

This inverse relationship explains why expensive markets have lower cap rates and affordable markets have higher cap rates. When property values rise faster than rental income, cap rates compress. Investors often accept lower cap rates in high-value markets expecting greater appreciation potential.

How to Use the Cap Rate Calculator

The calculator will instantly help you understand cap rates and how they can impact the quality of your portfolio.

Step 1: Adjust the Net Operating Income (NOI)

Move the top slider to match your property’s annual NOI. This number is your gross rental income minus operating expenses. Include rent, parking fees, and laundry income. Subtract property taxes, insurance, maintenance, management fees, and utilities. Do not include mortgage payments.

Step 2: Adjust the Property Value

Move the second slider to reflect your property’s current market value. Use recent comparable sales, an appraisal, or online valuation tools for guidance.

Step 3: Watch the Relationship

The red dot shows your property’s cap rate position. The calculation box reveals your exact cap rate. Notice how a higher property value means a lower cap rate—if NOI stays the same.

Why Understanding Cap Rates Matter

1. Snapshot of Performance

Understanding cap rates will provide an instant return measure, independent of financing. For example, a 4% cap rate means your property generates 4 cents per dollar of value each year.

2. Market Comparison Tool

Use cap rates to compare:

- Similar properties in Charleston – Are you underperforming?

- Other markets – Could you earn more elsewhere?

- Alternative investments – Are stocks, bonds, or REITs offering better returns for the risk?

3. Understanding Cap Rates Is The Framework for Investors Decisions

Hold your property when:

- Your cap rate matches or beats the local average.

- You expect rent growth or appreciation.

- Transaction costs outweigh the benefit of selling.

- The property sits in a prime Charleston location.

Consider selling when:

- Your cap rate falls more than 2% below market.

- Other properties offer 1–2% higher cap rates.

- The property needs major repairs.

- The market has slowed down with limited upside.

4. Portfolio Optimization-Understanding Cap Rates Leads To Good Decisions

Savvy investors use cap rates to:

- Identify underperformers dragging down returns.

- Guide reinvestment of 1031 exchange proceeds.

- Balance risk and reward.

- Time the market: sell when cap rates compress, buy when they expand.

5. Real-World Example-Here's How It Can Work

You own an Air BnB in Downtown Charleston worth $1,500,000 with an NOI of $35,000, that would be a 2.3% cap rate. Not great. So you search and find a comparable property delivers a 7% cap rate. Better! So by selling your under performing property and reinvesting in a 7% cap rate property, your annual income rises to $105,000. That’s $70,000 more each year!

The Bottom Line on Cap Rates

Understanding cap rates help you cut through emotions and focus on performance. Use them to answer the most important question every investor faces: Should I hold this property or sell and reinvest elsewhere?

Charleston investors can model different scenarios with a cap rate calculator. Always verify numbers using actual operating statements, not just projections. Real expenses often exceed estimates.

If you'd like an Asset Performance Test (APT) and a Capital Gains Exposure Analysis performed on your property(s). Call Bill Byrd 843-972-7670 for a confidencial private consultation.

Frequently Asked Questions - Cap Rate

A cap rate shows how efficiently a property generates income relative to its value. It helps investors evaluate performance, compare properties, and decide whether to hold, sell, or reinvest—without factoring in financing.

Cap rate is calculated by dividing a property’s Net Operating Income (NOI) by its current market value, then multiplying by 100. NOI includes rental income minus operating expenses, but excludes mortgage payments.

When property values rise faster than rental income, cap rates compress. This is common in high-demand markets like Charleston, where investors may accept lower cap rates in exchange for appreciation potential and long-term stability.

Investors often hold when cap rates meet or exceed local averages or when future growth is expected. Selling may make sense when cap rates fall well below market levels, repairs are looming, or higher-performing opportunities are available elsewhere.

Cap rates help identify underperforming properties, guide reinvestment decisions (including 1031 exchanges), balance risk and return, and time market cycles—selling when cap rates compress and buying when they expand.

A cap rate does not take debt service into consideration because it is designed to measure a property’s income performance independent of financing. This is so you can easily compare 2 or more properties income streams against one another.

About the Authors

Bill Byrd and Waverly Byrd serve clients throughout the Charleston area as Real Estate Wealth Advisors, helping individuals and families navigate complex property decisions connected to life transitions and long-term planning. Their work often involves, tax-advantaged 1031 exchanges, probate and estate property sales, divorce-related real estate solutions, trusts, and senior relocation, situations where informed coordination and careful timing can significantly impact outcomes.

With decades of experience, Bill and Waverly emphasize education, clarity, and collaboration. They regularly work alongside financial planners, tax professionals, and attorneys to help clients understand their options and align real estate decisions with broader financial and estate planning goals. As a father-and-daughter team, they guide clients through sensitive transactions with discretion, organization, and a steady, well-informed approach across the Lowcountry.