Our 8 steps to buying a home is designed to reduce the stress financially, emotionally, and practically.

It can feel exciting and overwhelming at the same time. Over the years, what we have consistently found is this: the more educated and prepared a buyer is, the smoother and more enjoyable the experience becomes.

At Byrd Property Group, we follow a proven, step-by-step process that removes uncertainty, keeps you informed, and protects your interests at every stage. Whether you are purchasing your first home, relocating to the Charleston area, or buying again after many years, these 8 steps to buying a home provide a clear roadmap from your first conversation to the day you receive the keys.

A Simple, Proven Process That Works

Buying a home does not need to feel complicated. When our clients follow these 8 steps to buying a home, they benefit from:

- Clear expectations

- Fewer surprises

- Better decision-making

- Stronger negotiating positions

This process mirrors the real-world buying journey outlined in our Byrd Property Group Buyer’s Guide and Home Buying Process infographic, both of which were created to visually and practically guide buyers from consultation to closing .

Let’s take a closer look at each step.

Step 1: Deciding To Buy!

Every successful home purchase starts with a decision, not just to buy, but to buy with intention.

If you are currently renting, have steady income, some savings, and a credit score in the higher-600s or above, financing options such as FHA or conventional loans may be available. However, qualifying for a loan and being comfortable with your payment are not the same thing.

Renting vs Buying Analysis

30-Year Financial Comparison

Over 30 years, buying builds substantial wealth through equity

Key Assumptions

Renting:

- Monthly rent: $2,271

- Rent increase: 3% per year

- No equity accumulated

Buying:

- Down payment: $100,000

- Monthly payment: $2,271

- Home appreciation: 4% per year

- 30-year fixed mortgage at 5.5%

At this stage, we help you evaluate:

- Your motivation and timing

- Your financial comfort zone

- Short- and long-term housing needs

How homeownership fits into your broader financial plan:

Many of our clients also save thousands by exploring financing options through our preferred lenders, which can offer competitive programs and streamlined coordination. Education comes first. Confidence follows.

Step 2: Hire Us as Your Buyer’s Agent

This is one of the most important decisions you will make during the process.

When you work with Byrd Property Group, you are represented by a fiduciary…someone legally and ethically obligated to place your interests first. Unlike the listing agent, whose responsibility is to the seller, a buyer’s agent works exclusively for you.

How We Help You Buy with Confidence

- Educate you about the Charleston market

- Focus on your needs, priorities, and concerns

- Identify homes that match your criteria

- Coordinate inspectors, attorneys, lenders, and vendors

- Negotiate price, terms, and timelines

- Track deadlines and paperwork

- Solve problems before they become issues

And importantly, our buyer representation is typically provided at no direct cost to you, as compensation is often paid by the seller.

Step 3: Secure Financing

Most buyers do not automatically know how much they can borrow…or how much they should borrow. That is completely normal.

This is why early conversations with a trusted mortgage professional are encouraged. A pre-approval clarifies your buying power and strengthens your position when making an offer.

The Financing Process at a Glance

- Choose a lender

- Complete a loan application

- Receive a pre-approval

- Select a loan program

- Submit an accepted contract

- Obtain appraisal and final approval

- Fund and close

Proper mortgage planning creates a smoother experience. While a lender may tell you what you qualify for, you always control what you are comfortable spending.

Pro Tip: Ask us about our preferred lenders! Working with lenders who already collaborate with our team adds an additional layer of accountability and communication.

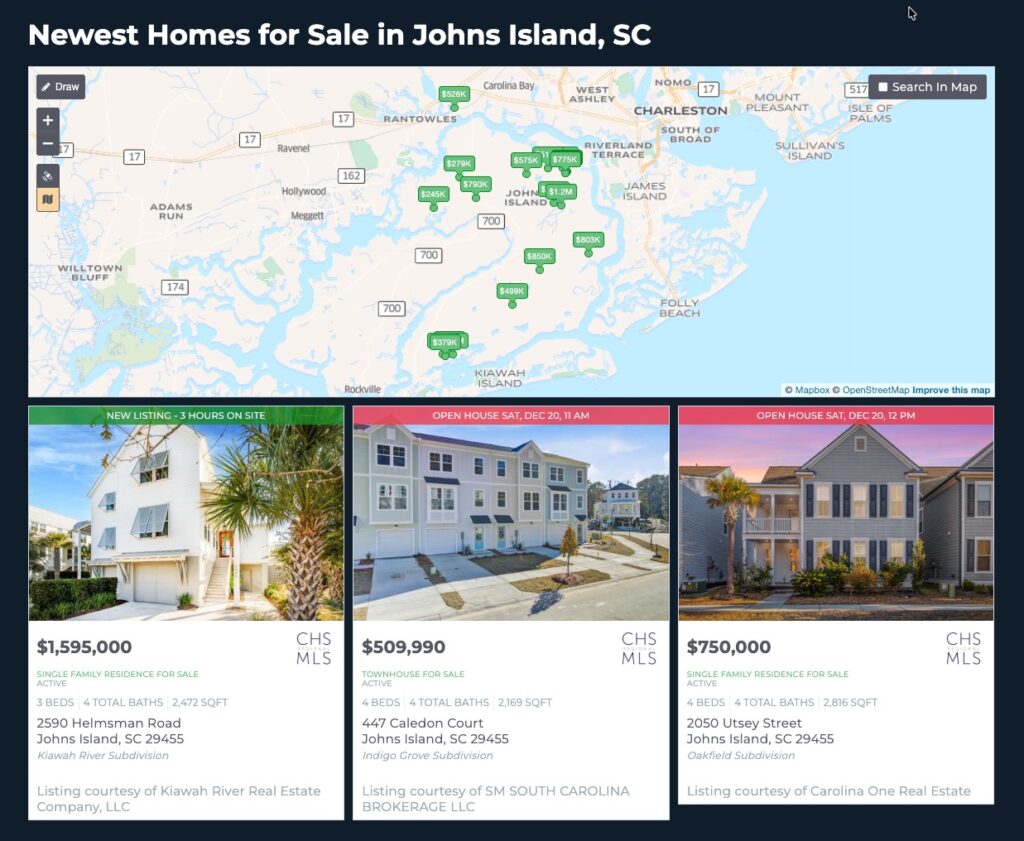

Step 4: Find the Right Home

Once you are pre-approved, the home search begins.

Before touring homes, we schedule a buyer consultation to clearly define what matters most to you. This conversation is essential, especially since this is often one of the largest purchases you will make.

Topics We Will Explore Together

- Preferred areas

- Space and layout needs

- Style and condition preferences

- Long-term ownership plans

- HOA considerations

- Future resale potential

Online searches are helpful, but nothing replaces seeing homes in person with your agent. We need to see every home you see. We need to hear your thoughts about those homes so we can better understand what you’re looking for. This allows us to better assist and guide you in the process.

Visiting properties allows you to understand:

- The setting

- Surroundings

- Nearby conveniences

- Overall feel of the area

Pro Tip: Photos and online listings can only tell part of the story. Seeing homes firsthand leads to better decisions.

Step 5: Make an Offer

Once you have found the right home, it is time to prepare a thoughtful and competitive offer.

Every offer includes three key components:

- Price – Based on market data and qualifications

- Terms – Timing, financing, and conditions

- Contingencies – Items that must be resolved before closing

Our Role During Negotiations

- Conduct a comparative market analysis

- Communicate with the listing agent

- Identify seller priorities when possible

- Review public records and disclosures

- Explain options and strategies clearly

Our goal is to help you feel informed, prepared, and confident before anything is signed.

Step 6: Inspections and Due Diligence

No home is perfect. Inspections exist to provide clarity…not to create fear.

Pro Tip: We strongly recommend attending the inspection so you can better understand the home’s condition. In South Carolina, sellers also provide a Seller’s Property Condition Disclosure, outlining known issues.

The inspection focuses on major systems and components such as:

- Structure

- Roof

- Electrical

- Plumbing

- Heating and cooling

- Moisture concerns

South Carolina contracts typically address inspections through a Due Diligence period, Due Diligence allows you to inspect any and all aspects of the home. From the structure, systems and appliances to the zoning, HOA and deed restrictions. Basically, it allows you the opportunity to inspect, review and analyse anything having to do with the property during the Due Piligence Period.

Step 7: Prepare for Closing

Once contingencies are resolved and the contract is fully ratified, preparation becomes critical.

During this phase:

- Avoid new credit activity

- Do not make large purchases

- Maintain steady employment

- Respond promptly to lender requests

You will also complete a final walk-through to confirm the property is in agreed-upon condition. Your lender will issue a Closing Disclosure at least three days prior to closing, outlining final figures.

Clear communication during this stage helps ensure a smooth closing day.

Step 8: Protect Your Investment

After closing, your focus shifts to protecting and maintaining your new home.

Routine maintenance, early repairs, and proper insurance coverage help preserve value over time. And your relationship with us does not end at closing.

We remain a resource for:

- Market value updates

- Contractor referrals

- Ownership questions

- Long-term planning

Our goal is to support you well beyond the transaction.

Frequesntly Asked Questions – Buying A Home

Timelines vary, but many purchases take 30–45 days once under contract.

Yes. Pre-approval strengthens your position and clarifies your budget.

Yes. A buyer’s agent represents your interests, provides guidance, and helps navigate negotiations, timelines and deadlines.

Closing costs typically range from 1–5% of the purchase price and include lender, title, and insurance fees.

Contracts include specific terms outlining cancellation rights. We review these carefully before you sign.

The Due Diligence period is 100% negotiable, seller usually want it to be as short as possible. And buyers typically want it as long as possible. With that said in the last 5 years the Due Diligence Periods for our sales have been in the range of 7 -15 days.

Authors

Bill Byrd and Waverly Byrd bring deep real estate expertise to clients throughout the Charleston area, drawing on years of hands-on experience with residential sales, investment property, relocation, and local market strategy. Their guidance is grounded in market knowledge, careful analysis, and a commitment to helping clients make well-informed real estate decisions.

As a father-and-daughter team, they work collaboratively on every transaction, combining experience, perspective, and consistent communication. Clients benefit from a coordinated approach that emphasizes preparation, clarity, and thoughtful execution at each stage of the buying or selling process across the Lowcountry.