Sold in 4 Days, 5 Offers and $15k Over List!

Welcome to 115 Valentin Dr. in Plum Creek. Located in the Knightsville section of Summerville, Plum Creek is convienently located off of Orangeburg Rd. with easy access to local shopping and I26 for all of your needs.

Plum Creek fits nicely into the popular Dorchester District Two Schools System, which makes this home a great choice for the school conscience home shoppers!

Check Out The Tour!

115 Valentin Dr. Summerville SC 29483

This fine home has 4 bedrooms and 2.5 baths, with 2,269 sq ft, 115 Valentin Dr. is able to accomodate a variety of lifestyles. Having a large sceen porch and a big backyard those looking for easy outdoor living will be impressed with the proch, patio and yard space.

Additionally, having a traditional room count with a living room, dining room, kitchen and den, along with a screen porch it’s easy to feel comfortable in this familiar layout. 115 Valentin Dr is a place that you’ll happily enjoy calling home.

For those interested in having a large two car garage, 115 Valentin Dr will not disappoint here either. With plenty of space for tools and tools this homes 2 car garage can easily accomodate your storage or hobby needs.

115 Valentin Dr. Features

- Large 2nd Floor Master Bedroom

- 4 Total Bedrooms

- 2.5 Baths

- Full Size Kitchen With A Solid Surface Counter Top

- Popular Hickory Kitchen Cabinets

- Oversized Integrated Kitchen Sink

- Stainless Steel Appliances/Black Oven Cooktop

- Large Breakfast Area

- Open Traditional Floor Plan

- Hardwood Floors In Foyer & Dining Room

- Open Den With A Gas Fireplace And Built-in Cabinets

- Sliding Glass Doors Lead To The Screened Porch

- Large Dining Room

- 2 Full Baths Upstairs

- Wall To Wall Carpet Upstairs & In the Den & Living Room

- Freshly Painted

- An Attached 2 Car Garage

- Wide Front Porch

- Enormous Screen Porch

- Ground Level Patio Off The Screen Porch

- Dorchester 2 Schools

- Architectural Shingles

- 2 Zone Gas HVAC

- Gas Water Heater

- Central Air

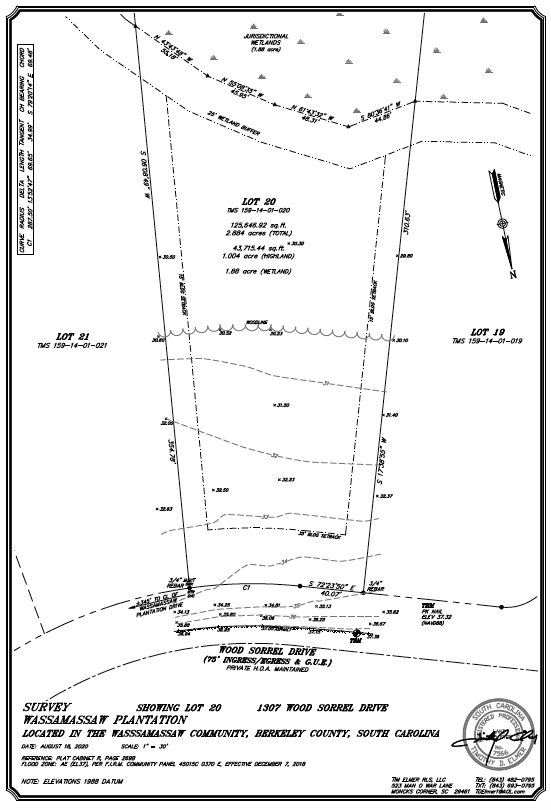

- 65 x 135 Lot

- Rear Yard Privacy Fence

If you’d like to see this home please feel free to call Bill Byrd at 843-972-7670 or Waverly Byrd at 843-790-2675. And if you have specific questions please feel free to reach out to us either by filling the form out below or give us a call or text!