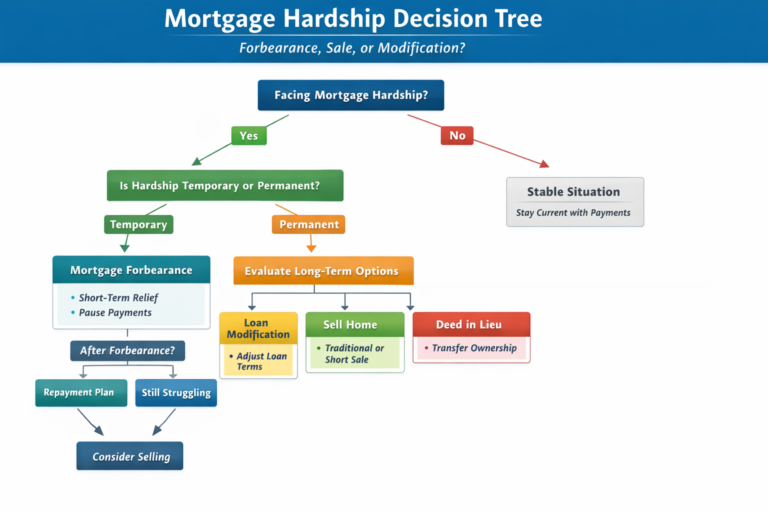

What is Mortgage Forbearance?

Understanding Temporary Payment Relief and How It Works Mortgage forbearance is a temporary agreement between a homeowner and a mortgage lender or servicer that allows payments to be paused, reduced, or adjusted for a defined period of time. The purpose…