Are Online Home Values Often Inaccurate?

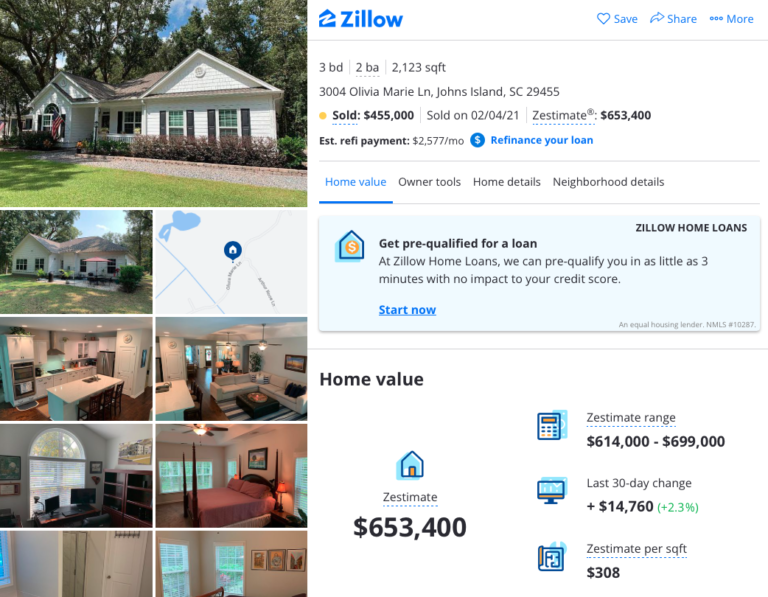

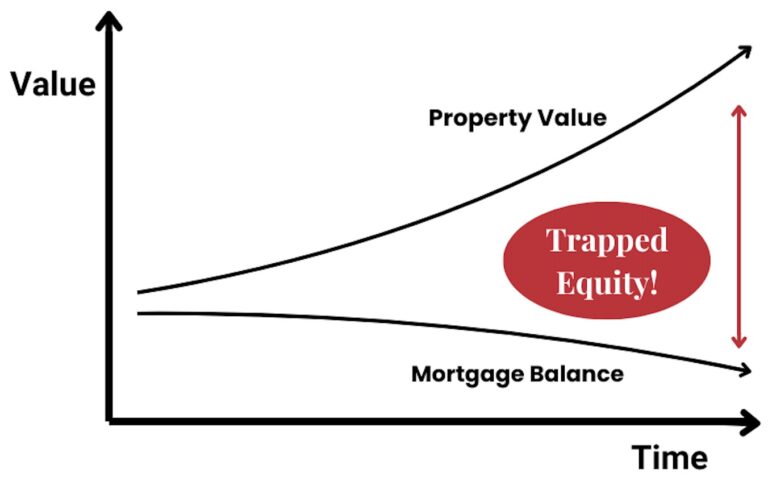

Why Online Home Values Are Often Inaccurate…and What Sellers Should Know Instead If you’ve ever searched your home online, you’ve likely seen an instant home value pop up within seconds. These online estimates are convenient, widely used, and tempting to…